In my opinion implied volatility (IV) is the most useful of the option greeks. Implied volatility can be used to adjust your risk control, trigger trades and in a future video I will show you how you can actually trade options on the market’s own implied volatility level. Implied volatility is relatively simple to understand but it hard to predict. It changes as investor sentiment changes and can be very sensitive to the overall market environment. In this series we will be talking about IV and how it can be used to forecast market direction and make trading decisions.

[VIDEO] Using Option Greeks: Implied Volatility, Part 1

Implied volatility is a measure of what investors think about future volatility. This means that it reflects what traders “think” about the potential for the underlying stock or index. That information is extremely useful when you can see and analyze those changes over time. Implied volatility will rise when traders are concerned about risk or are becoming very fearful. Conversely, implied volatility will fall when investors are very confident or bullish. This matters to option traders because an increase in implied volatility causes a rise in option premiums. That is bad for option buyers but can be good for sellers. When implied volatility is falling and traders are becoming more bullish, option prices fall and being a call buyer may be a better alternative than being a put seller.

In the video above we will talk about how implied volatility changes prices and why this matters to investors.

One of the most useful forms of implied volatility is the implied volatility index of the S&P 500 index options (SPX) usually known as the VIX. In a very real way the VIX reflects the fear of the general population of investors. This can be useful as a way to understand the strength of a given trend and as a way to forecast reversals in the market.

[VIDEO] Using Option Greeks: Implied Volatility, Part 2

The VIX will show the relative risk or fear in the market compared to recent history. Traders will try to identify those points in the VIX when investor sentiment or fear has reached extremes. In the video I will show you several good examples of what to look for to find periods of excessive fear and bearishness as well as too much bullishness. These periods often lead to reversals in the market which is a good time to reduce market exposure and begin looking for new opportunities.

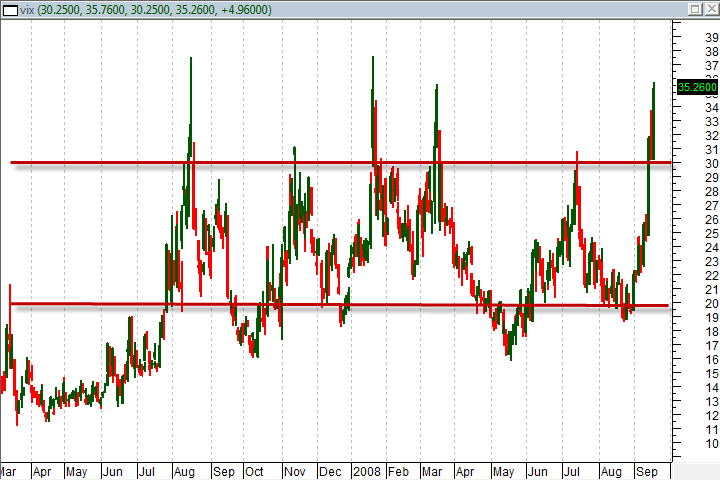

As you can see, in the chart below, one of the things we look for when evaluating whether the VIX or investor sentiment is at extremes is whether or not the index is at the top or bottom of its channel. When the index is at resistance (the top of the channel,) we know that fear is at an extreme and we should be controlling any market exposure to the downside of the market very conservatively. It does not mean that we should automatically become bullish but, it does mean that we will act as prudently as possible to control the risk in any short positions or long puts.

Conversely, the market and traders in general can become over confident. Quite often a bounce off the lower side of the channel can indicate a significant shift in investor sentiment from low risk and growth to high risk and volatility. The channels on the VIX will shift over time but typically stay within a given range, such as the one shown on the chart, for several quarters to a few years.

When I talk to traders about the VIX and how to use it to understand what is going on with investor sentiment they will often get very interested in trading the channel it tends to stay within. I also think that is a good idea since channels can be very profitable for traders. However, although there are calls and puts available for traders on the VIX they are unique compared to most calls and puts that stock option traders are used to. In order to make this article about implied volatility as practical as possible I think a discussion about how to trade options on the VIX will be useful.

[VIDEO] Using Option Greeks: Implied Volatility, Part 3

1. The VIX options are not based on the index, they are based on the VIX futures.

If you are not a futures trader, this subject may seem complicated but it really isn’t that hard to understand. What you need to know is that the VIX is also traded as a futures contract and there are one of these futures contracts available for each of the next few future months. This means that the current month’s VIX futures contract looks very similar to the VIX index but the futures contract that expires next month may look a little different because it will show what investors think about the market in the next month. Traders may be very fearful of current market conditions right now but they may not be as fearful about where the market will be in a month or two months. That means that the VIX futures contract that expires this month will have a higher (more fearful) reading than next month’s VIX future contract or the month after that and so on.

2. Each month’s option chain sheet corresponds to the same month’s VIX futures contract.

Imagine that today’s reading on the VIX index is 30 and the VIX futures contract that expires this month is priced at about the same level. That is normal and therefore the at the money strike price will be 30. The calls and puts at the 30 strike price should cost a similar amount per contract as you would expect. However, if next month’s VIX futures contract is currently priced at 25 because traders are less fearful about the market next month then the at the money strike prices for next month’s options will be 25 not 30. In the video I will show you how this works and why it can lead to a serious mistake by new traders. Most of the time, your broker’s online trading station will not make this obvious and it can lead to traders drawing incorrect conclusions about the VIX options from one month to the next.

3. VIX options have an unusual expiration date.

Equity traders are used to stock options and index options expiring on or just before the third Friday of the month. VIX options are different and have a very unusual expiration date. Fortunately, you can get an expiration calendar to assist your planning from the CBOE. VIX options expire on the Wednesday that is at least 30 days before the 3rd Friday of the month following the expiration month. Got that? Here is how that works – Imagine that you are holding September 2008 VIX calls. The expiration month for those options is September so we need to find the 3rd Friday of the next month, which is actually October 17th. Counting backwards from October 17th to find the first Wednesday that is at least 30 days prior to October 17th gives us an expiration date of Wednesday, September 17th. We can make the same calculation to determine that October’s options will expire on Wednesday, October 22nd. If that seems complicated just get yourself an expiration calendar and don’t worry about trying to work out the math.

VIX options can be an important part of a well diversified trading strategy. Institutional traders use VIX options to hedge risk and to profit from market uncertainty and fear. The price channel can be easy to identify for a technician and fundamental traders can use them to offset risk as growth begins to slow.