The Federal Reserve (the Fed) was established nearly 100 years ago by the Federal Reserve Act of 1913. And while knowing the date the Federal Reserve was established isn’t crucial to your investing success, understanding how the Fed works will help you understand what is happening in the financial markets and who the players are. Let’s take a look inside the Federal Reserve and learn more about the following:

– The Board of Governors

– The Federal Reserve Banks

– The Federal Open Market Committee (FOMC)

[VIDEO] Structure of the Federal Reserve

The Board of Governors

The Board of Governors of the Federal Reserve is a seven-member group that is ultimately responsible for overseeing everything that happens within the Fed. Each of these seven governors is appointed by the President of the United States and must be confirmed by the U.S. Senate. Each member of the board serves a 14-year term. The current members of the Board of Governors are as follows:

– Ben Bernanke

– Donald Kohn

– Kevin Warsh

– Randall Kroszner

– Elizabeth A. Duke

Now, you will notice that I have only listed five people here. At this time, the President and the Senate have not filled all of the seats on the board.

One of the members of the Board of Governors—currently Ben Bernanke—serves as the chairman of the Fed.

Federal Reserve Banks

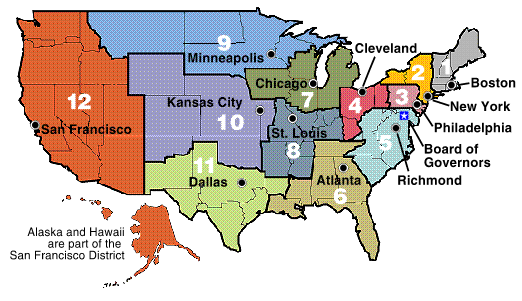

The Federal Reserve System divides the United States into 12 districts, and each district is overseen by a Federal Reserve Bank. Each Federal Reserve Bank is responsible for overseeing the member banks within its district, monitoring the economic conditions in its district and providing information to the Board of Governors and the Federal Open Market Committee (FOMC). The following is a list of the 12 Federal Reserve Banks.

– District 1: Federal Reserve Bank of Boston

– District 2: Federal Reserve Bank of New York

– District 3: Federal Reserve Bank ofPhiladelphia

– District 4: Federal Reserve Bank ofCleveland

– District 5: Federal Reserve Bank ofRichmond

– District 6: Federal Reserve Bank of Atlanta

– District 7: Federal Reserve Bank ofChicago

– District 8: Federal Reserve Bank of St. Louis

– District 9: Federal Reserve Bank of Minneapolis

– District 10: Federal Reserve Bank of Kansas City

– District 11: Federal Reserve Bank of Dallas

– District 12: Federal Reserve Bank of San Francisco

The Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is the entity that determines what the federal funds rate should be and oversees the implementation of its interest-rate policies in the Fed’s open market operations. The FOMC consists of the seven members of the Board of Governors, the President of the Federal Reserve Bank of New York and a rotating group of four presidents from other Federal Reserve Banks. The President of the Federal Reserve Bank of New York is a permanent member of the FOMC because the Open Market Operations (OMO) trading desk is located at the Federal Reserve Bank of New York. The FOMC meets eight times per year to discuss the Fed’s monetary policy.