Stock investors are bargain hunting! Periodically that is a headline for a lot of news articles after a general market decline. It does seem logical doesn’t it? For example, after the 2007/2008 decline prices had been cut by 40-60% so surely they must have been some bargains out there.

Video Analysis: Value Investing Principles

This is a great example of why the financial news is extremely unreliable. Writers must find a “cause” for each day’s movement but those causes are not consistent over the long term and are usually nothing better than random guesses.

However, financial reporters are driven by a primal need to find the reason why something happened so we will continue to see these kinds of headlines in the future.

Bargain hunting implies that a stock is worth less than it should be and is therefore undervalued. Being able to pick undervalued stocks or so called value-investing would be quite a talent but is there really such a thing as an undervalued stock?

Because a stock’s price is a combination of investor estimates for future growth/revenue/dividends/etc. it is logically only a matter of opinion as to whether that stock is undervalued.

Will my estimate for future growth be better than any other informed investor? Probably not but this doesn’t mean that there isn’t any value

I have found that value investing concepts may help to increase long term returns. If you are a longer term trader then using reasonable value measures to evaluate a stock before you add it to your portfolio is a great way to help smooth your returns and equity curve by avoiding volatility and increasing the odds for success.

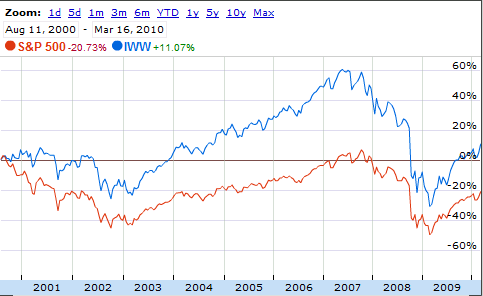

A good comparison between “value” investing and the broad market indexes can be seen through two ETFs. The chart below compares the SPY (indexed to the S&P 500) and the IWW (indexed to a group of “value” stocks within the Russell 3000). As you can see, over the long term IWW has outperformed the SPY. This can make a big difference to investors concerned about ongoing high levels of volatility in the market.

IWW vs SPY

There are as many value measures as there are value investors but some are more useful than others. In this article we will start the discussion behind a value measure or multiple you can use to screen stocks as that may be “overvalued” or more volatile than stocks that are “undervalued” or likely to be less volatile from other possible picks.

As I mentioned there are many ways to apply a value measure to a stock but probably the most common is the P/E or Price/Earnings ratio. Dividing a stock’s price by its earnings per share is a standard way to grab a snapshot of a stock’s value. A very high P/E infers that the stock is overvalued and probably volatile. A lower P/E usually seems better but it doesn’t account for growth.

In the next article we will talk about how to combine the P/E ratio with a stock’s growth rate or expected growth rate to create the PEG ratio. It is one of the best ways to screen stocks easily and quickly because it summarizes so much information about a company’s financial performance in an easy to understand snapshot.

Usually value investors are looking for stocks with low value multiples or ratios. While there are many of these, probably the most popular version is the P/E or Stock Price to Earnings ratio. The drawback to a P/E ratio is that it does not account for growth. A low P/E may seem good but if the company is not growing, its stock’s value is also not likely to rise.

Video Analysis: Value Investing Principles

The P/E ratio can be enhanced by including growth and turning it into the PEG ratio. A PEG ratio is calculated by dividing the stock’s P/E ratio by its expected 12 month growth rate.

One of the most notable proponents of this analysis was Peter Lynch (of Fidelity Investments fame) who suggested that a fairly valued stock will have a growth rate roughly equal to its P/E ratio.

That means that a fairly valued stock will have a PEG ratio of 1. A lower PEG ratio may indicate a good value and a PEG ratio much greater than one could indicate that a stock is overvalued.

As an example of value investing I introduced the iShares S&P 500 Value Fund (IVE) that replicates the results of a subset of the S&P 500 that meet basic value parameters. This is a good example of the concepts discussed in this article series becuase that fund’s P/E ratio and PEG ratios are both lower than the average ratios of all the stocks in the S&P 500 index itself and its performance has been better than the index over the last 5 years. However, if you are not inclined to invest in an ETF, you can easily accumulate a portfolio of stocks with good PEG ratios through one of the many free searches available on the internet.

Fundamentally speaking, the PEG ratio is more than it appears. In one ratio you have established that the company has profits, growth expectations and a reasonable stock price relative to its financial performance. These are not always givens in today’s stock market. Using some minimal fundamental screening within a well diversified portfolio is a great way to remove some volatility from your own portfolio’s equity curve.